Some or all of the products featured here are from partners who compensate us. These partnerships may influence which topics or products we cover but do not influence our reviews. Money Armada is an independent publisher.

Timberland is a type of real estate that has become incredibly popular recently. And it’s easy to see why — there’s just something about owning a piece of nature that people find appealing. But how much does an acre of timberland cost? What drives the price of timberland? And what are some of the best places to invest in timberland? Let’s take a closer look at all those questions and more.

How Much Does an Acre of Timberland Cost?

The value of timberland depends on many factors, such as the type of stand, the species of tree(s), the location, the market conditions, the quality of the product, and the age of the trees. In addition, there are several different types of stands, each with varying characteristics.

On average, an acre of timber costs $1,500 if it’s from a tree plantation. If timber comes from a naturally-forested area, it can command a $500 premium, increasing the price to over $2,000.

What Decides the Price of Timberland?

The law of supply and demand determines the price of timber. In short, the more there is of something, the less it costs. This principle applies to both raw materials like timber and finished goods like furniture.

Demand and price of timber varies based on location and availability of mills and timber.

Timberland owners in the American southeast primarily manage their land to grow larger stands. Owners typically prefer to manage their land for producing high-value large pine logs rather than medium-sized pine logs because the former provides higher returns over the long term.

Even-age management practices are preferred because they allow landowners to harvest trees at roughly the same size, thereby increasing the number of large pine logs produced.

In addition, large pine logs are easier to transport and store than small diameter logs and provide better quality lumber. They also require fewer resources to produce.

Invest in Farmland

Platform | Investments | Pros | Link |

| U.S. Farmland | Competitive Returns | |

| West Coast U.S. Farmland | Access to a secondary market | |

| South American Farmland | Open to non-accredited investors |

How Much Do Trees Sell For?

Timber companies pay for trees based on size, location, species, and market value. You can make money selling wood, but there are many factors involved in determining how much you’ll actually receive. A tree might cost $100 to purchase, but could fetch $10,000 if it’s located near a city. And if you’re lucky enough to find a rare variety of hardwoods, like red oak, you could end up making hundreds of dollars per tree.

How to Invest in Timberland in 2022

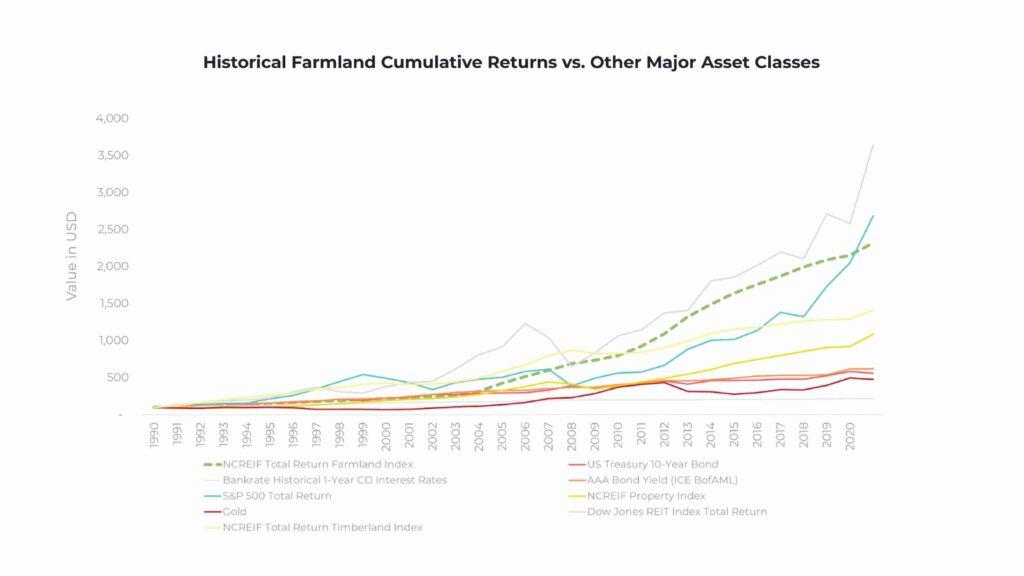

One reason to invest in timberland is to diversify your portfolio. Investing in this asset, can serve as a complement to stocks over the long term. This asset can also deliver growth to your portfolio and deliver solid returns over the long haul.

One of the best ways to invest in timberland is through Timberland REITs. These investment vehicles offer investors exposure to the timber industry without having to own actual timberland. Instead, these funds invest in publicly traded companies that operate in the timber industry.

Some REITs to consider include:

- Potlatchdeltic Corp – PCH (NASDAQ)

- Catchmark Timber Trust – CTT (NYSE)

- Weyerhaeuser – WY (NYSE)

- Rayonier – RYN (NYSE)

Another way to invest in timberland is through platforms like Acretrader. Acretrader is a crowdsourced platform which allows you invest in farmland and see returns through the farmland appreciating and from rents.

You can also directly buy timberland itself directly. This method will be more cost-intensive and you’ll need to have the means to cut and mill the timber directly. Check out this useful guide on timberland ownership.

Conclusion

To wrap up this article, an acre of timberland costs $1,500 – $2,000 and we can expect this land type to only grow in value based on previous trends. The price of timberland is driven by location, quality, sizes, among other factors.

Investing in timberland is definitely achievable for the average person whether they’re investing in public REITs, through crowdfunding platforms, or by buying timberland directly.