Some or all of the products featured here are from partners who compensate us. These partnerships may influence which topics or products we cover but do not influence our reviews. Money Armada is an independent publisher. Not investment advice.

Welcome to The Alt Investor- Money Armada’s newsletter covering all things alternative investing. This week, we are covering wine prices, but also one of the most famous types of investments: Art investing. Believe it or not, it is not an investment vehicle reserved for the rich anymore.

Also- we are running a promotion for our early subscribers. Right now, refer 5 subscribers and get paid $5! When you refer a subscriber, email tyler@moneyarmada.com with the email address that you referred, and once you hit 5 we will PayPal/ Venmo/ Zelle you $5! It is that simple.

Fine Wine Prices Softening? Time to Buy

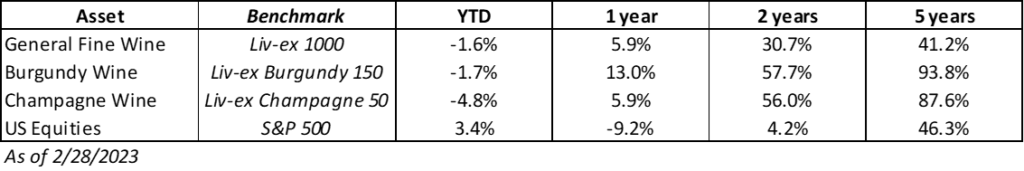

Since May 2020, wine prices have been appreciating at a comfortable rate for investors. Even with market turbulence in 2022, there still was strength in the wine market. However, this growth in the early months of early 2023 seems to be slowing, with the Liv-ex 1000 dipping -1.6% YTD, and the Liv-ex Burgundy 150 declining -1.7% by 2/28/2023. Champagne was even worse, falling 4.8% since Jan 1, 2023.

Compared to equities this decline could seem concerning (S&P 500 is up 3.4% so far in 2023). However, this should be seen as a buying opportunity for fine wine investing. While this year wine has not grown as fast as it has in the past, on a longer timeline wine investments far outperforms equities over the past 5 and even 10 years.

Also keep in mind that because wine is a tangible asset it is less volatile than stocks. This increases its stability as an asset, and should really be considered with a medium or long term holding strategy. Fine wine is not for day trading! It should be seen as an investment device to diversify your portfolio and generate extra alpha on top of other investments, such as stocks, bonds, and real estate.

The Top Regions for Fine Wine

As we discussed a few weeks ago, Fine Wine comes in all colors, flavors, and are from different regions. Not all regions are the same, and some are better performing investments than others.

Traditionally, the Bordeaux region of France was seen as the top dog in Fine Wine trading and investing. However, the best performers of the Fine Wine space were actually Champagne and Burgundy wine. Liv-ex, one of the leading benchmarks in wine price movement, has both a Burgundy 150 and Champagne 50. Both of these can be used to track wine price movements and trends.

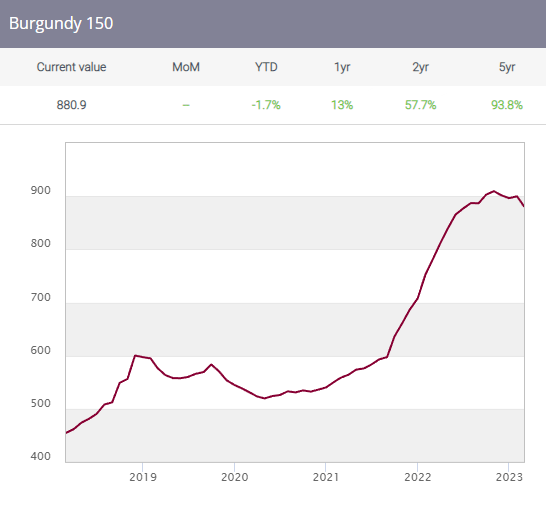

Burgundy Wine in 2022 and 2023

Over the past 12 months, the Burgundy 150 grew 13%, which led the regional wines in overall return. While all wines are following a general path of upward mobility in 2022 and a slight dip in 2023, Burgundy saw the highest returns for all positive years, and limited losses to only 1.7% YTD.

A large reason for this is due to the Burgundy 2021 vintage en primeurs release tightening due to severe frost and mildew challenges in the region. Since supply is limited, the price is remaining steady.

Champagne Wine in 2022 and 2023

Champagne saw a tougher start to 2023, with its YTD return slipping -4.8%. However, the devil is in the details with Champagne investing, and when zooming out the wine’s investment returns are actually quite good.

Over the past 12 months, champagne returned nearly 6%, and 56% when zooming out another 12 months. Champagne also increased its market share in the Liv-ex 1000 in January of this year. Louis Roader Cristal 2014 led the pack with volume traded, however prices are lower on a per unit basis than their late 2022 highs.

Going forward, Champagne is expected to continue being a strong player in the general Fine Wine market, even with the initial volatility at the start of the year.

Fine Wine Outlook in 2023

Like many assets, Fine Wine exploded in value over the course of 2020 and 2021. This is partly due to overall inflation and the universal bull run experienced due to central bank policies. However, as asset prices consolidate, wine holds strong as a safe haven.

Part of the reason wine will always be sought after is its limited and ever-decreasing supply. There are only a certain amount of bottles to be sold and drank of each vintage of fine wine. As bottles get consumed, the supply drops, and the bottle becomes rarer. Over the long term, this should only increase the price of certain wines- it’s just a matter of picking the ones that will appreciate faster than others.

What is Crowdfunding? The Tech Behind Art and Card Investing

With technology, alternative investing has made even the most niche forms of investing more accessible to the masses. Artwork is being divided into “virtual shares” and sold online, sports cards, sports memorabilia, and other expensive collectibles are getting the same treatment.

Ultimately, crowdfunding is making this all possible. Crowdfunding is the general term for raising capital “from the crowd”, i.e. the public. For example, charity organizations are an example of crowdfunding (donations).

One of the earliest implementations of rewards crowdfunding was Kickstarter. Kickstart is one of the most famous platforms for launching projects and raising money in return for “rewards”. This often is in the form of a product, a special item in a video game, or really anything. It all is based around the product that you are funding for.

Debt crowdfunding is where true “investing” comes into play- you contribute your money to debt crowdfunding in order to earn a return. Peer-to-peer lending is a form of crowdfunding, and platforms like Lending Club utilized this business model to connect small business owners that need a loan with investors that want to lend their money.

Equity crowdfunding (ECF) is the newest player in the crowdfunding space. This type of fundraising was not allowed until 2016 when the government allowed retail investors to invest in private companies Pre-IPO.

ECF essentially allows many investors to all invest money and have ownership in an expensive asset by breaking it up into many different shares. For example, when investing in a $10,000 bottle of wine on VinoVest, ownership is broken into hundreds of shares split amongst investors. These shares are then traded on the platform, and on the secondary market. This is how these investments are liquid!

Equity crowdfunding is now one of the fastest growing ways to invest, and this is what makes nearly all of the alternative investing space possible. With ECF, you can invest in:

- Rare Artwork

- Sports Cards

- Wine

- Whiskey

- Farmland

- Businesses

- And More!

We will be writing an entire piece on Equity Crowdfunding soon, but it is important to understand the technology driving alternative investing. Money Armada covers all of these investments and more- check out our website for further reading on alternative investing!